Definition and you can Examples of Amortization

Normally, the brand new payment continues to be the same, and it’s split up among attention costs (exactly what your lender becomes covered the loan), lowering your loan equilibrium (also known as “settling the borrowed funds dominant”), and other costs such as assets fees.

The past loan fee pays off the total number leftover on the loans. Such as for instance, immediately following exactly 3 decades (or 360 monthly installments), it is possible to repay a thirty-seasons home loan. Amortization tables help you know how a loan works, and makes it possible to expect your a good equilibrium or attract costs at any point in the near future.

Exactly how Amortization Work

How to understand amortization is through evaluating an enthusiastic amortization desk. When you have home financing, the brand new desk included your loan records.

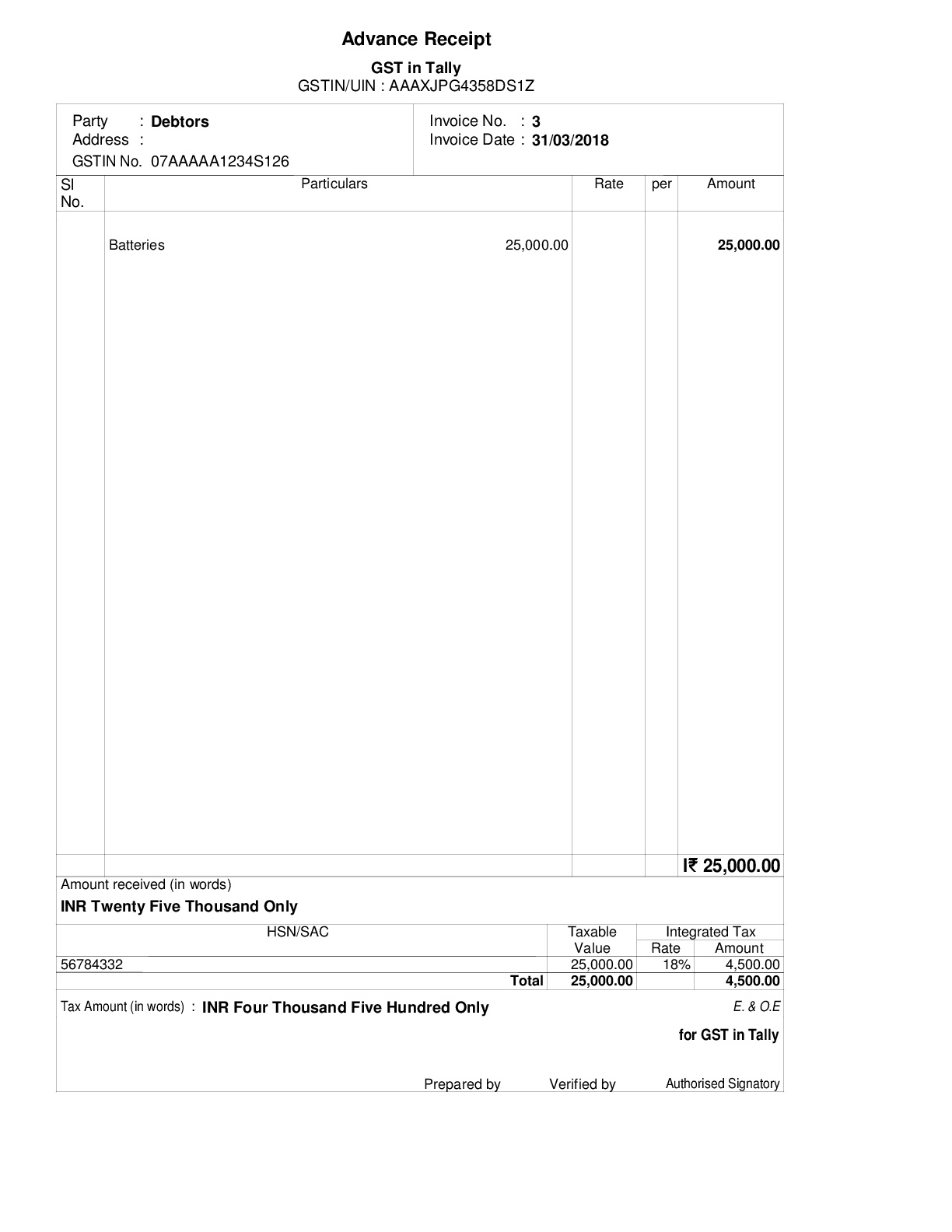

A keen amortization dining table is a plan one listing for each month-to-month loan payment and exactly how much of for every percentage visits focus and exactly how much on the dominant. Most of the amortization desk has got the same kind of pointers:

- Planned repayments: The called for monthly payments are indexed actually because of the day on the length of the borrowed funds.

- Principal fees: When you use the attention costs, the remainder of your fee goes toward paying the debt.

- Attention costs: From each scheduled fee, a share visits attention, which is computed from the multiplying your leftover financing harmony by your month-to-month interest rate.

In the event your own complete commission stays equal for every months, you’ll end up paying off the fresh new loan’s appeal and you may prominent in various amounts per month. At the beginning of the borrowed funds, desire prices are at the their highest. Someday, much more about of every fee goes to your own dominant, and you spend proportionately reduced within the interest per month.

A typical example of Amortization

Often it is useful to understand the amounts in place of training from the the process. Brand new dining table less than is named an enthusiastic “amortization dining table” (or “amortization plan”). They helps guide you for each fee affects the loan, exactly how much you pay in notice, and just how far you owe into the mortgage at any provided time. That it amortization agenda is actually for the beginning and stop away from an auto loan. This will be an excellent $20,100 four-12 months loan recharging 5% desire (that have monthly payments).

To see the full schedule or help make your very own dining table, fool around with a loan amortization calculator. You can also explore a great spreadsheet to create amortization dates.

Sorts of Amortizing Loans

There are various kind of money readily available, in addition they do not all of the works in the same way. Repayment fund is amortized, while spend the money for equilibrium down seriously to no over the years which have level repayments. They is:

Auto loans

Speaking of commonly five-seasons (otherwise quicker) amortized finance that you lower which have a fixed payment. Stretched financing arrive, but you will spend more to your focus and you can exposure getting inverted in your mortgage, definition your loan exceeds your automobile’s resale value for many who stretch anything away too long to locate a reduced fee.

Home loans

Speaking of usually fifteen- otherwise 31-year fixed-speed mortgages, which have a predetermined amortization schedule, however, there are even varying-rates mortgage loans (ARMs). Which have Possession, the lending company is also to change the interest rate for the a fixed agenda, which will impact your amortization agenda. Most people you should never contain the same financial to have fifteen otherwise 3 decades. They sell the house otherwise re-finance the mortgage at some point, but these fund act as if a borrower had been browsing have them for the whole title.

Unsecured loans

These finance, which you are able to get out of a financial, borrowing connection, otherwise online financial, are generally amortized financing also. They often have about three-year terms, repaired rates of interest, and you can fixed monthly installments. They could be utilized for brief systems or debt consolidation.

Credit and Finance Which are not Amortized

- Handmade cards: With your, you could a couple of times borrow on an identical credit, and also you reach choose just how much you can pay back monthly if you meet the minimal percentage. These money also are known as “revolving debt.”

- Interest-simply financing: These financing don’t amortize sometimes, at the very least not at first. When you look at the attention-simply several months, it is possible to only pay on the dominating if you make recommended more repayments above and beyond the attention prices. Will ultimately, the lending company requires that start paying dominant and you can attention to the a keen amortization plan otherwise pay the loan entirely.

- Balloon finance: These financing means you to generate a large principal fee after the loan. In early many years of the loan, it is possible to generate short money, although entire loan appear due in the course of time. In most cases, you will likely refinance the fresh balloon fee if you don’t has actually a huge amount of money available.

Benefits of Amortization

Thinking about amortization is beneficial if you’d like to recognize how borrowing from the bank work. People usually build decisions predicated on an easily affordable payment per month, but focus prices are an easy method to measure the real price of what you get. Often a lower life expectancy payment per month in fact means you can easily pay a whole lot more within the desire. Eg, for those who stretch out the fresh new fees day, you are able to pay even more during the appeal than you might to possess a smaller repayment identity.

Don’t assume all mortgage facts are part of an elementary amortization plan. Specific amortization tables reveal more factual statements about financing, also fees for example settlement costs and you may collective attract (a running total exhibiting the full attention repaid immediately after a specific amount of time), but when you don’t get a hold of these records, pose a question to your bank.

With the information outlined for the an amortization table, it’s easy to check additional loan possibilities. You could potentially contrast lenders, choose between a fifteen- or 29-season mortgage, otherwise determine whether to refinance an existing mortgage. You may also estimate how much cash you’d rescue if you are paying off obligations very early. With most financing, you get to help you ignore all kept attract charge if you have to pay them of very early.

Recent Comments