23

Oct 2024

There are specific financing apps designed to focus on people who have fico scores to 650

With a credit score on the Fair range makes it seem like your options for a property mortgage are restricted, but that’s maybe not totally real. Let’s speak about these feasible home loan alternatives.

FHA Loan

An effective avenue having prospective property owners that have a credit score from 650 is the Federal Homes Management (FHA) mortgage. Such loans provide competitive rates of interest and want a deposit as low as 3.5%, so it’s a stylish option for earliest-big date homebuyers and the ones that have moderate income membership. The relaxed credit standards and lower down payment allow it to be much more easier for people who have a good 650 credit score to qualify.

FHA fund may also be used to rehabilitate the home your was to buy, if you don’t pick a great deal and build your ideal household. Refinancing that have otherwise without cashing out security is even readily available.

USDA Mortgage

The newest U.S. Agencies out of Farming (USDA) loan program is an additional option to imagine, taking capital to possess reduced so you’re able to average-money borrowers inside outlying areas. Having good 650 credit rating, somebody can be eligible for an effective USDA mortgage instead of requiring people advance payment. While such loans dont lay particular minimal credit history criteria, they are better-fitted to people who meet the earnings and place conditions, giving good opportunity for people seeking to homeownership without a hefty down-payment.

Virtual assistant Loan

To have experts, active-obligations provider users, and you can qualified thriving partners, the brand new Va mortgage program offers beneficial terms and will not set at least credit rating requisite. Regardless of if a good 650 score is considered acceptable, per financial may have her tolerance.

Virtual assistant financing give tall gurus such as for instance zero down payment, zero individual financial insurance coverage needs, and you will aggressive rates, making them an interesting choice for whoever has supported otherwise still suffice the country.

Each one of these financial systems has its own book masters and qualification requirements, so it’s important to talk about the options that have our loan officials observe whether it’s best program to have you.

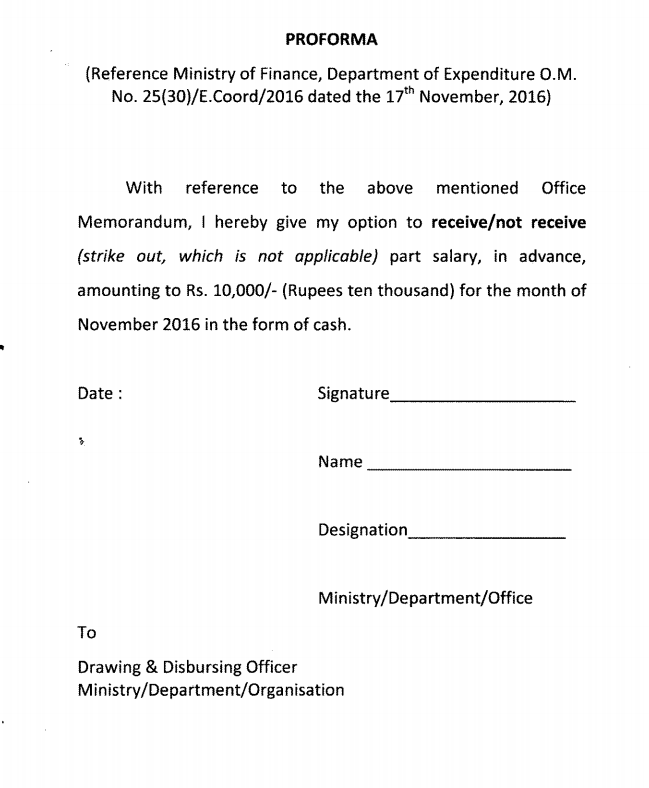

Requisite Records to own Lenders

When you get a home loan, the loan officer often ask you to bring various documents to to analyze as part of the financing recognition process. Here you will find the head brand of documents and that is expected:

Income Verification

Attempt to establish your capability to settle our home loan, therefore taking earnings verification becomes necessary. Records eg pay stubs, W-dos models, and you can taxation statements are simple when trying to get home financing. This type of files give proof of a career and you may earnings balance, soothing the lender about your monetary features.

Investment Information

As well as your earnings, lenders will like to see factual statements about your own assets. This includes comments away from bank accounts, old age otherwise resource membership, and just about every other possessions you may have. This provides understanding of your current monetary stability and will have shown your ability to deal with profit sensibly.

Credit history

At some point we will demand permission to find a full credit file from all the around three biggest credit reporting agencies (Experian, Equifax, and you may TransUnion) to evaluate your own fee Lone Tree loans record, a good bills, and the quantity of exposure you perspective given that a debtor. Examining your credit history before applying to own a mortgage is essential.

Handling one wrong entries otherwise negative scratches on your own declaration is also help to improve your odds of acceptance or safer a beneficial rate of interest.

Don’t lower higher balance accounts if you don’t chat which have financing manager. You can even brought to repay or leave certain membership delinquent until just after their financial closes.

Recent Comments