Blogs

You can get a flat amount of revolves to make use of for the any otherwise all available online ports rather than added bonus money. Australians is also claim free revolves no deposit as a result of of several preferred local casino websites. It’s as well as a very good way to have casinos to advertise particular games titles. No deposit free spins are definitely more perhaps one of the most common type of that it added bonus, as it can be used on searched casino slot games online game otherwise other harbors one to belong to a comparable classification. The new winnings can still be withdrawn because the actual money, but the players have to bet him or her a couple of times, as it is constantly said having including a deal. All the casino incentives offered, may only be wagered on the online slots, but there are several exclusions that will allows you to gamble a myriad of video game; dining table games including.

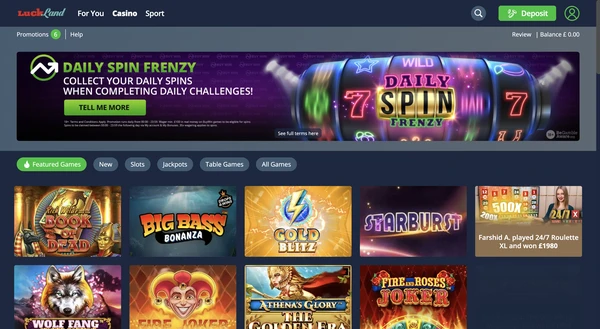

Ladbrokes casino online top: Cherry Silver Casino $15 100 percent free Chip and 315% Ports Matches Thanksgiving Acceptance Incentives Banquet

If your last balance end up being more than your own carrying out harmony, you’ll be able to be eligible for a better acceptance package in your first deposit. Will you be an enthusiastic Australian Online casino Player, and you are clearly looking an online gambling enterprise where you could get the very best experience of whenever betting? Windward Gambling establishment has furnished your for the platform; all you need is to sign up with them.

Tips Allege $75 No-deposit Bonus?

The good news is, you still have the option to open up the newest live specialist games to see what they’re including before you make a deposit. If you are searching to possess higher online casino games to enjoy with the free added bonus code render, you can’t fail to the casinos i’ve on the our very own listing. The brand new 100 percent free gamble promotion try lesser known but may still be bought at multiple Australian-against web based casinos. You can essentially get trial credits that you could appreciate to have a keen time.

Information these computations support people bundle the gameplay and create their Ladbrokes casino online top bankroll efficiently in order to meet the fresh wagering conditions. This information is crucial to possess promoting the advantages of totally free spins no-deposit incentives. Wagering standards determine how often professionals have to bet its payouts away from 100 percent free spins before they are able to withdraw him or her. Such standards are essential because they dictate the genuine accessibility participants need to its payouts. Antique 100 percent free spins always trigger bonus money that needs betting in order to withdraw, while zero wagering totally free spins allow it to be players to maintain their payouts instantly.

You must consider the advice given in this article thereby applying it during your next casino gamble. We frequently inform every piece of information about the bonuses and codes, to help you always be touching the fresh. Everything you requires is a bit piece of luck so you can import which extra to a happy local casino feel.

Support otherwise VIP incentives are utilized because the incentives to possess normal, energetic professionals who deposit/wager/done work appear to. He’s according to collected comp otherwise commitment points to own participants’ total membership interest and certainly will become exchanged for free bucks, 100 percent free potato chips, otherwise free spins. Large VIP account attract more big added bonus models and better wagering conditions. You are thought a recently available party associate when you yourself have a profile and also have played in one place for a long day. Anything you need to do is seek out gambling enterprise bonuses to possess existing players and implement for them. Yes, established participants will benefit away from constant no deposit also offers, commitment programs, and you can unique advertisements.

Go for game one contribute far more for the wagering criteria and now have advantageous chance. This may give you an advantage inside taking advantage of the no put incentive. But exactly how can you get hold of such private no put bonuses?

Greatest 100 percent free Revolves No deposit Bonuses to have 2024 Win A real income

Publication out of Dead is an additional preferred position game usually included in totally free revolves no-deposit bonuses. The game are graced because of the a free spins feature that includes an increasing symbol, which notably increases the possibility of huge victories. The fresh thrilling gameplay and you will large RTP build Guide out of Deceased a keen sophisticated choice for participants seeking to maximize its free spins incentives. Betting standards are usually calculated by the multiplying the bonus count because of the a particular rollover contour.

People is redeem no deposit incentive requirements provided by the new casino to help you claim specific extra also offers, which can be then paid on the accounts for immediate play with. You’ll rarely become given a flat level of games to try out, however, it depends to the sort of incentive you get. In order to withdraw winnings on the 100 percent free spins, professionals have to fulfill particular wagering standards put by the DuckyLuck Casino. So it ensures a reasonable betting feel if you are enabling people to benefit from the no deposit totally free revolves also provides.

Recent Comments