Michael jordan provides instantly stored over $30,000. Next 5 approximately decades, they’ll be able to pay adequate to coverage new guaranteed portion of the loan. It means its parents will not getting liable and they can consistently pay with the rest of the mortgage.

How much time does a great guarantor stick to our home mortgage?

Normally, guarantors usually are liable for a mortgage anywhere between dos and you will five years. The exact distance is determined by when the buyer might possibly pay brand new guaranteed part of the mortgage, and how quick the house develops inside value.

Let us set you back from greater standards out-of what has to happen before a beneficial guarantor can be put-out in the loan:

- The consumer needs produced costs punctually to possess at the minimum the past 6 months

- The loan must have an enthusiastic LVR (Mortgage in order to Worthy of Ratio) of below 80%

- The customer should satisfy most of the lender’s requirements (eg that have a credit score, stable earnings and you will a career)

While we stated, parents and family relations are capable of being a beneficial guarantor to your a primary-family buyer’s mortgage. The guarantor will have to very own their house downright (or perhaps have a good quantity of guarantee offered), keeps a reliable source of income, and good credit records becoming approved by very loan providers.

If you’ve been questioned to behave due to the fact an effective guarantor of the an effective friend, it is important to understand risks of being a good guarantor to have a mortgage:

- You happen to be guilty of repaying the complete financing (and you will attract!) in case your customer isn’t able making the repayments.

- You years your credit score in the event your secured loan actually paid back back. This is certainly detailed as a standard in your credit file.

- You could jeopardise the experience of all your family members user if things you should never check out bundle and you’re put into pecuniary hardship because the on the mortgage plan.

Exactly what are the pros away from a beneficial guarantor mortgage?

The largest advantageous asset of securing an excellent guarantor financing is the prospect of savings because the a primary-date domestic customer.

- Steer clear of the expenses of LMI: having a beneficial guarantor placing submit their house as the safeguards, finance companies and lenders wouldn’t ask you for large LMI advanced (which can easily total up to tens and thousands of dollars).

- Safer possessions with a lower life expectancy deposit: a good guarantor mortgage makes you enter into the market less that have lower than an effective 20% deposit. In some cases, you are capable secure a loan with just a great 5% put, shaving many years off the journey into the homeownership.

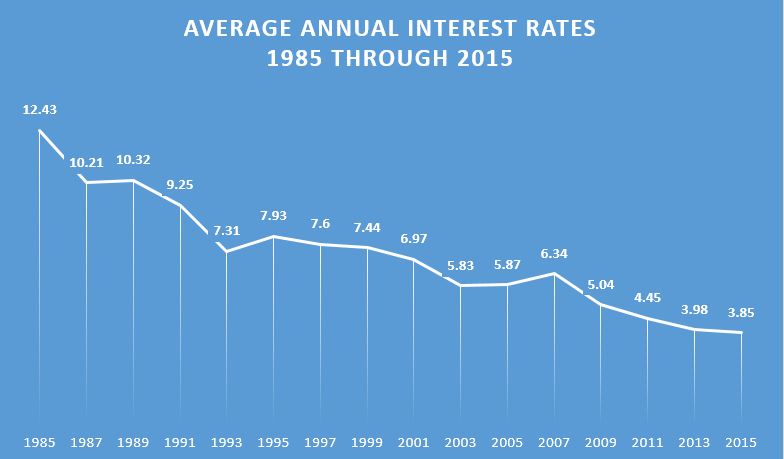

- Rating a better rate of interest: having a great guarantor opens up alot more home loan options for you due to the fact a purchaser. By cutting your risk once the a debtor, lenders are more inclined to make you entry to a whole lot more aggressive interest rates. This may help save you several thousand dollars for the interest across the life of your loan.

Should you want to safe that loan off $700,000 having a deposit regarding just 5%, you would be caught with a predetermined rate of interest from step 3.44% to help you cuatro.34%. not, if you safeguarded a beneficial guarantor financing one https://paydayloanalabama.com/mount-olive/ enabled you to definitely come to a 20% deposit, you could score a varying interest only step 1.99%.In place of good guarantor, you would certainly be paying over $450,000 from inside the attention along side lifetime of your loan. not, with a beneficial guarantor loan, would certainly be expenses merely over $192,000 in the attract. That is a prospective cost-saving away from $258,000!

There is the back

- Jordan’s moms and dads agree to guarantee the kept fifteen% ($105,000) of one’s financing put to cease the necessity for LMI.

Recent Comments