twenty-two Oct Absolutely the Help guide to Automobile financing having Pros

The acquisition away from a new auto would be pleasing and you may thrilling, whether you are purchasing one for yourself or anybody you like. However,, the whole process of bringing accepted getting automobile financing for veterans can become difficult. Don’t worry, even though. There are numerous choices for obtaining an auto loan though you’ve got bad credit if any borrowing from the bank.

In this post, you will then see everything you need to discover to shop for a car or truck as a veteran, such as the particular auto loans, where you’ll get one to, what you need to become approved, and you can what type of car to get. Let us diving into the!

Seeking a Va Loan getting an auto?

Brand new You.S. Agencies away from Veterans Factors (VA) doesn’t actually promote auto loans. Although not, through the vehicle allotment and you will transformative gadgets work with, the new Virtual assistant will assist pros and you can active obligations army that have to find an automible.

Where you might get an auto loan to have Pros

As stated over, you can not get a car loan privately from the Va for example you could which have Va home loans. In the event that, but not, youre struggling to push on account of a disability suffered while you are to the energetic obligations, you may qualify for an automobile work for.

This is certainly known as the car allocation and you may adaptive devices benefit in the united states, that offers a one-date payment as much as $21,488 in order to pros that have being qualified injuries.

Since you can’t score an auto loan on the Va, we now have built-up a list of choices below to possess where you can begin your quest.

Dealer Financial support

Transitioning away from effective duty to help you civil existence can be difficult. An alternate life isn’t the simply difficulty, since you may and additionally deal with the fresh financial dilemmas.

While an experienced and consider to find an auto otherwise you desire special products, you have possibilities. These may tend to be obtaining Va direction, researching military-specific rates off vehicles producers, and securing investment out-of borrowing from the bank unions concentrating on offering army personnel.

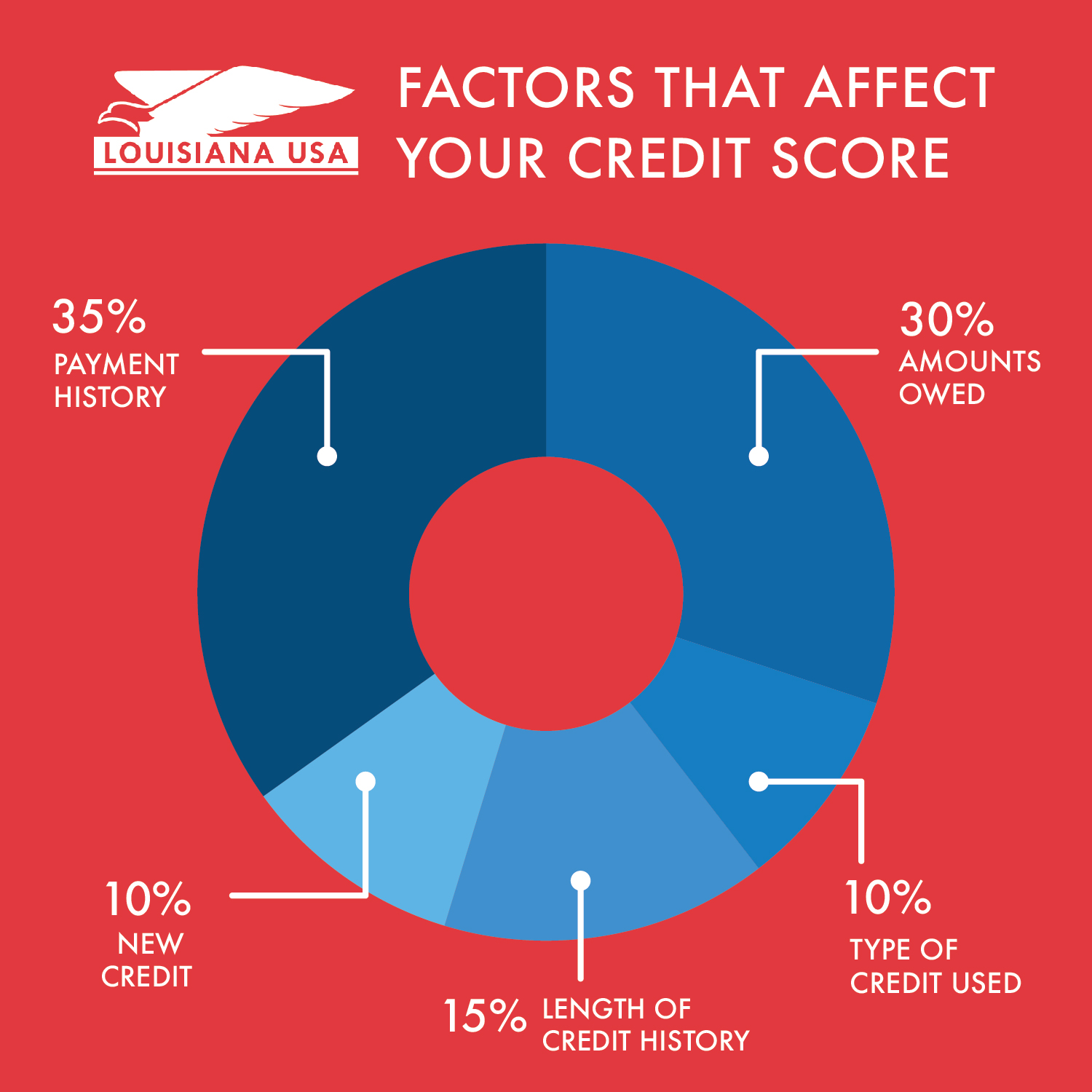

Essentially, investors bring your credit history into consideration whenever deciding if or not your qualify for a financial loan or otherwise not. Whenever you are having trouble getting that loan, you might have to alter your borrowing health first.

Borrowing Unions Automotive loans That have Savings or Unique Prices to have Pros

Overall, borrowing partnership automotive loans having veterans is inexpensive to own your in the event the a good Va work for isn’t offered someplace else. Instead of making a profit, borrowing unions work on helping their members.

A card connection will get save some costs for many who meet up with the criteria. Conventional loan providers might not have a knowledgeable choices for military team, very request a card connection you to provides them specifically.

PenFed Credit Partnership

PennFed, or the Pentagon Federal Credit Connection, caters to army teams and certain civil associations. As you need build a primary deposit of $5 to your a savings account to participate, PenFed you are going to give you glamorous financing terms and conditions along with their car-to invest in services.

Navy Government Borrowing from the bank Relationship

If you’re throughout the Army, Marine Corps, Navy, Air Push, Coast-guard, Air Federal Guard, otherwise retired armed forces, you can also consider Navy Federal Credit Union for your car loan. NFCU registration is also available to particular civilians, such as for example regulators personnel.

It offers funds for brand new and you may put trucks, motorbikes, or any other vehicles, but it does perhaps not bring funds to own utilized automobile purchased regarding private sellers otherwise rent buyouts.

Once the a member of NFCU, you can be eligible for competitive auto loans when you find yourself in the marketplace to possess a different or used car. You may also qualify for an extra 0.25% interest disregard if you choose head put for your month-to-month costs.

Recent Comments